Tax Revenue & Management

Streamline steps, from registration and filing to revenue accounting and collections, for an integrated experience for both taxpayers and tax authorities.

Gravity IT is globally recognised as SAP experts/system integrators in the Tax and Revenue Management space. Gravity IT also leverages its in depth knowledge to further develop cloud solutions tailored to seamlessly integrate with the SAP Tax and Revenue Management Core Industry Solution.

SAP Tax and Revenue Management for the Public Sector is a leading cloud-based solution designed to streamline tax administration through seamless integration and automation. Hosted on a private cloud, it offers tax authorities the flexibility to align with evolving business and IT strategies while adapting to regulatory changes.

With its modular design, the solution supports multiple tax types and provides a unified taxpayer view, improving service delivery and reducing complexity. It enables tax agencies to optimize the entire tax lifecycle—from registration and filing to revenue accounting and collections—ensuring a cohesive experience for both taxpayers and authorities.

Transitioning to cloud-based solutions provides substantial benefits, enabling swift adaptation to legislative changes while ensuring robust security, compliance, and advanced AI capabilities. With AI integrated into SAP software, tax agencies can harness machine learning and predictive analytics to anticipate taxpayer behaviour and enhance compliance. These AI-driven features not only aid in detecting tax evasion and fraud but also empower agencies to engage taxpayers proactively, narrowing the tax gap and increasing voluntary compliance.

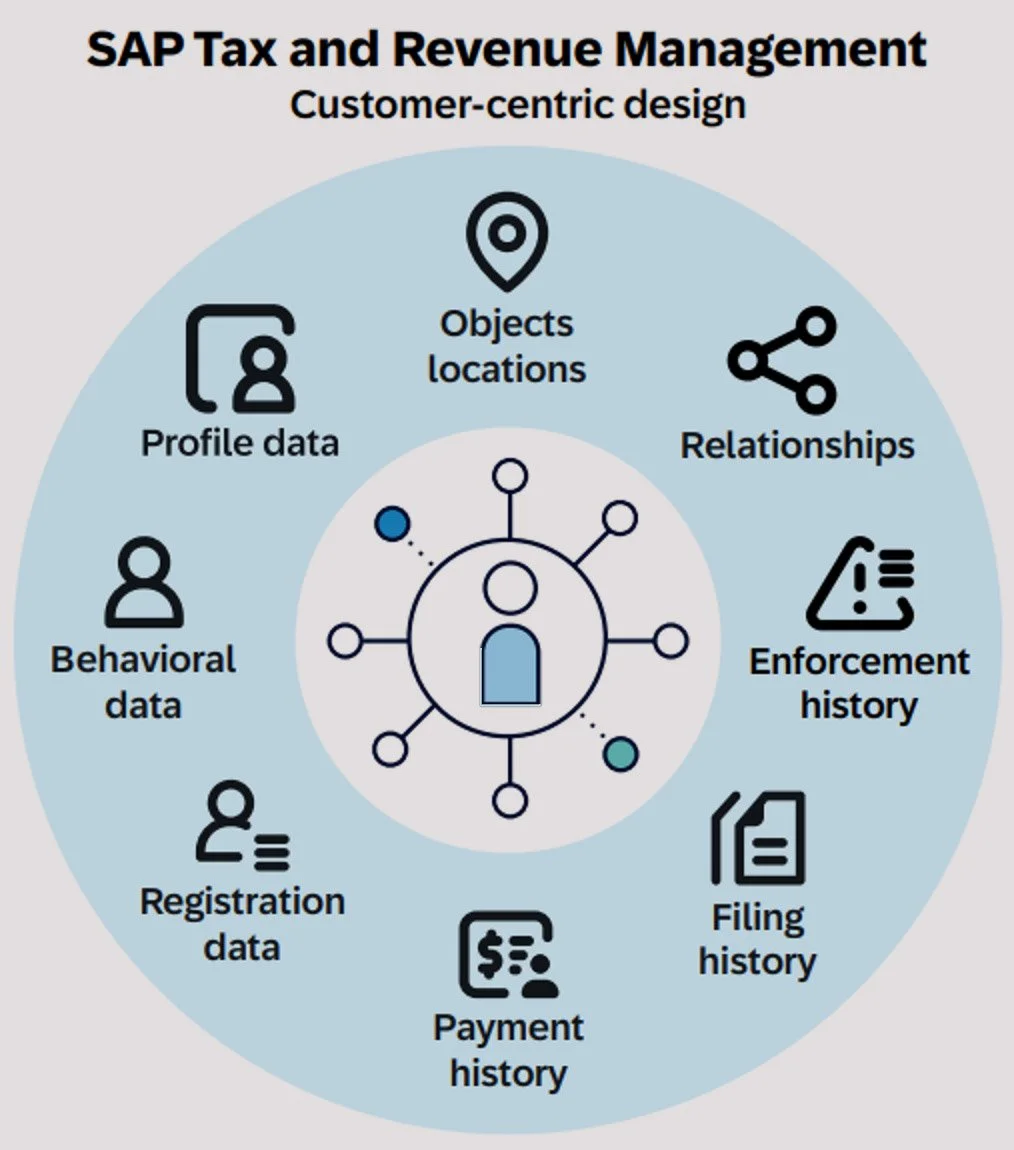

SAP Tax and Revenue Management is built with a customer-centric approach, focusing on the taxpayer to enhance engagement and service delivery. By offering a comprehensive 360-degree view, the solution consolidates data from multiple sources, allowing tax agencies to provide a more seamless and personalized experience.

Profile Data & Registration History: Centralizes all taxpayer-related information, including registration details and profile data, for easier access and more efficient processing.

Behavioural Insights: Utilizes machine learning to predict taxpayer behaviour, enabling agencies to anticipate issues such as late payments or noncompliance.

Payment & Filing History: Provides real-time visibility into a taxpayer’s filing and payment records, ensuring greater transparency and improved service delivery.

Relationships & Enforcement History: Tracks taxpayer relationships and enforcement actions, allowing authorities to respond swiftly and effectively to emerging risks.

With this comprehensive view, tax agencies can enhance taxpayer engagement, improve compliance, and make more informed decisions using data-driven insights.

“Gravity IT deliver! They will help you instil trust in your organisation through digitization, innovation and transparency. It has been a great partnership to date, and we look forward to even more success stories with our trusted partner, Gravity IT”

Luenne Gomez-Pieters, Managing Director of the Aruba Tax Department

“Gravity IT has been instrumental in the delivery and support of our revenue management systems, with SAP TRM and DCM at the core. Their professional and responsive approach to the COVID-19 relief measures is testament to their abilities, capabilities and knowledge of our business and SAP”

Simon McKee, Commissioner Queensland Office of State Revenue